Fxstreet

Investing Com

The Impact of Bitcoin Halving on Price Predictions

Bitcoin Halving: An Overview

Bitcoin's halving, an event that occurs every four years, refers to the process where the block reward for mining Bitcoin is reduced by half. This event significantly influences Bitcoin's supply and demand dynamics and can have implications for its price.

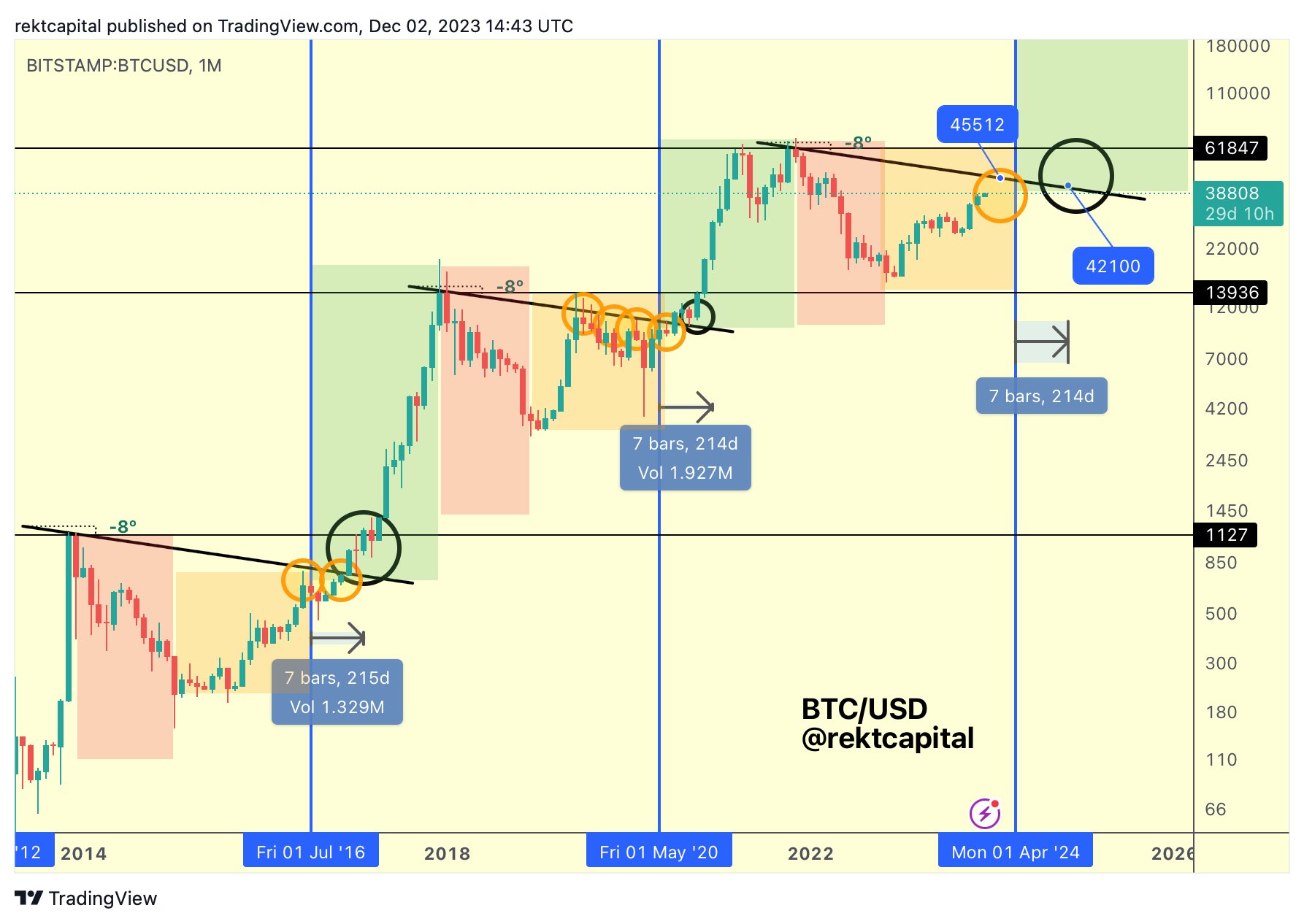

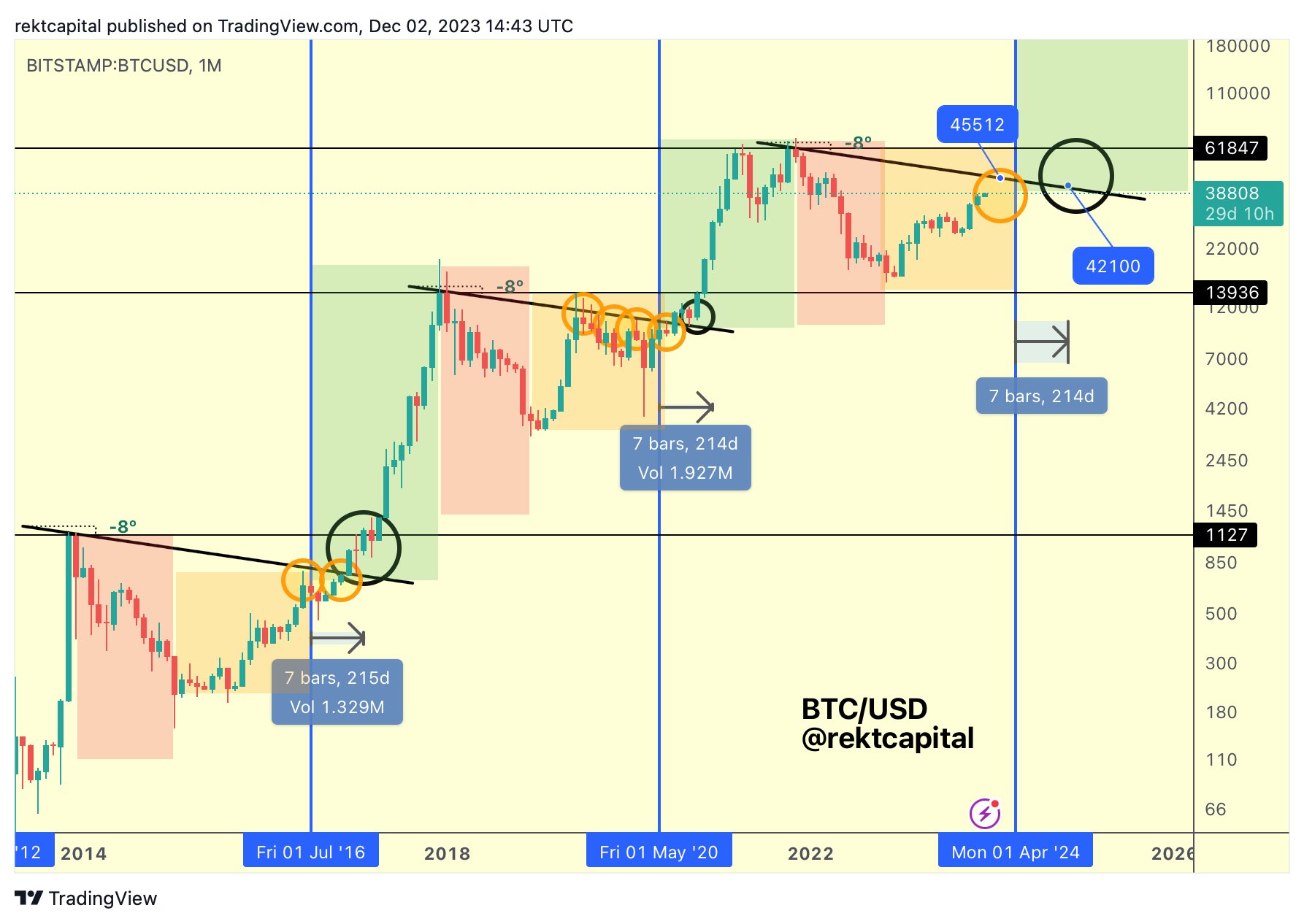

Past Halving Events and Price Trends

Historically, Bitcoin's price has shown a tendency to rally in the lead-up to each halving event. For instance, during the 2020 halving, Bitcoin's price surged to a record high of over $19,000 before experiencing a significant correction. Similar patterns were observed during previous halvings in 2016 and 2012.

Upcoming 2024 Halving

The next halving event is expected to occur in April 2024. While the specific impact on price is uncertain, analysts predict that it could lead to another significant rally in Bitcoin's value. As the supply of Bitcoin decreases, its perceived scarcity could drive up its price.

Factors Influencing Bitcoin's Price

However, it is important to note that the price of Bitcoin is influenced by a multitude of factors, including macroeconomic conditions, regulatory changes, and market sentiment. The halving event is just one piece of the puzzle that affects its overall price trajectory.

Implications for Investors

For investors and traders, understanding the potential impact of the Bitcoin halving is crucial. By considering historical trends and analyzing market conditions, investors can make informed decisions about their crypto investments. However, it's essential to exercise caution and diversify one's portfolio to mitigate risks.

Comments